Best of both worlds

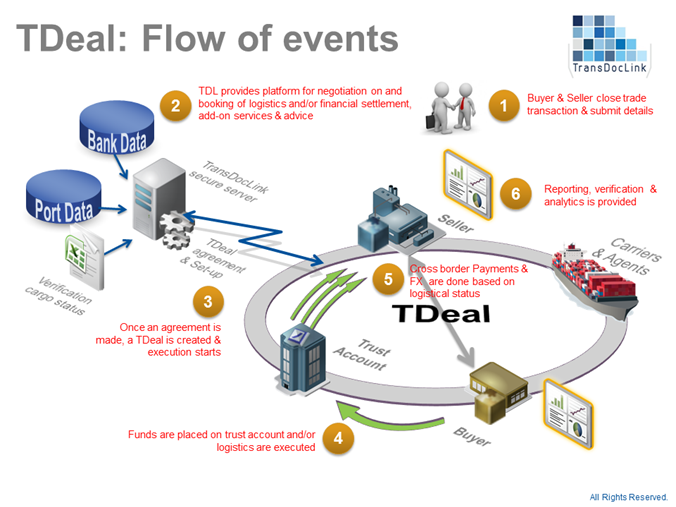

The TransDocLink platform provides you with the best practises from both the logistical industry as well as the financial we call TDeals. TDeals provide an integrated way of delivering our products best fitting your trade requirements.

A TDeal consists of:

- A Smart Contract

- A Multi-Currency Wallet

- Document handling & workflow automation

- Track & Trace of cargo

- Payment schedule & execution based on evidence of delivery

- Compliance transaction monitoring

- Trade Finance/ Supply Chain Finance integration via partners

- REST-API integration capabilities

- Reporting & audit trail

- Security on tier-1 banking level

This way you can focus on your core business and leave the rest to us.

TransDocLink helps you cope with trade related challenges

TransDoclink provides a platform that delivers a full range of services for your Supply Chain

The model TransDocLink applies delivers a full range of services & coordination between all stakeholders in the supply chain. Transparency & automated execution & coordination created ultimate transparency, ease of use & risk mitigation.

Based on the McKinsey Global Payments Practise model the TransDocLink platform applies Model 3 where we open doors for non-bank lending (e.g. crowdfunding of invoices & Purchase Orders) and enlarge the credit facilities that traditional banks will grant by

- Reducing risks

- Enhancing transparency

- applying the platform as collateral management tool

- reduce costs

Starting at the Purchase Order creates new opportunities & business models

TransDocLink covers the entire Supply Chain & all stakeholders enabling new business models toe be created.

Challenge: The process to engage in international trade is complex and sometimes unpredictable

Solution:

- A single Platform with both logistical workflow as well as financial settlement that provides actual status based on real-time harbor data (Track & trace of cargo)

- Usage of INCOTERMS as a basis for trade execution & payment schedules

- Option to use advice module for decision-making

- Option for quotation & actual execution of the logistics by trade partner

Challenge: Total costs of documentary collections is difficult to calculate. Total cost of the entire trade transaction is even more complex to calculate due to the scattered entities in the value chain (banks, customs, tax authorities, customs, port authorities, etc.).

Solution:

- TransDocLink handles funds in a third party trust account. Real time status information is provided about the balance & down payments per trade transaction via several channels

- During contract negotiation the TDeal platform assists in a graphical manner the choice of risk associated with the transaction

- Costs of both the trade as well as the logistics is immediately provided & accurate

Challenge: A tool to do proper analytics on your trade transaction is often not available or scattered around specific topics

Solution:

- Historical database of transactions & reference of anonymized other trade transactions

- Accurate forecasting capabilities (both financial as well as logistical) based on very accurate settlement triggers (e.g. gate moves, chosen payment moments, clearance costs based on HS-codes)

Challenge: Not knowing your counterparty causes risk in trade execution, both on the logistical and on the financial settlement side. However, during the commercial negotiation about a trade transaction, the risk vs. reward trade-off should be part of the deal

Solution:

- The platform enables traders to make very specific agreements with their counterpart concerning the payment schedule & INCOTERMS. These agreements are part of the final negotiation.

- Comparison between different INCOTERMS & total product price combinations is provided including calculation of own costs (clearance, tax, residual transportation etc.), thus enabling genuine risk – reward trade-off.

- Checks & balances are available for your actual cargo, ensuring both delivery & quality of goods